T08-0001 - Options to Adjust Social Security Earnings Cap, Static Impact on Individual Income and Payroll Tax Liability and Revenue ($ billions), 2009-18 | Tax Policy Center

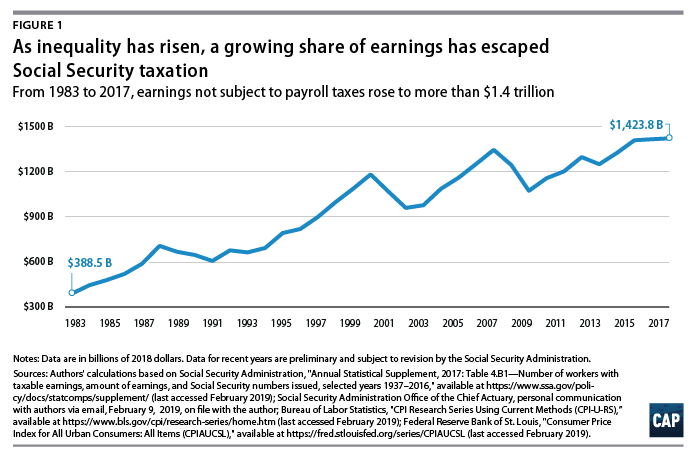

Here's How Much America's Rising Income Inequality Is Costing Social Security - Center for American Progress

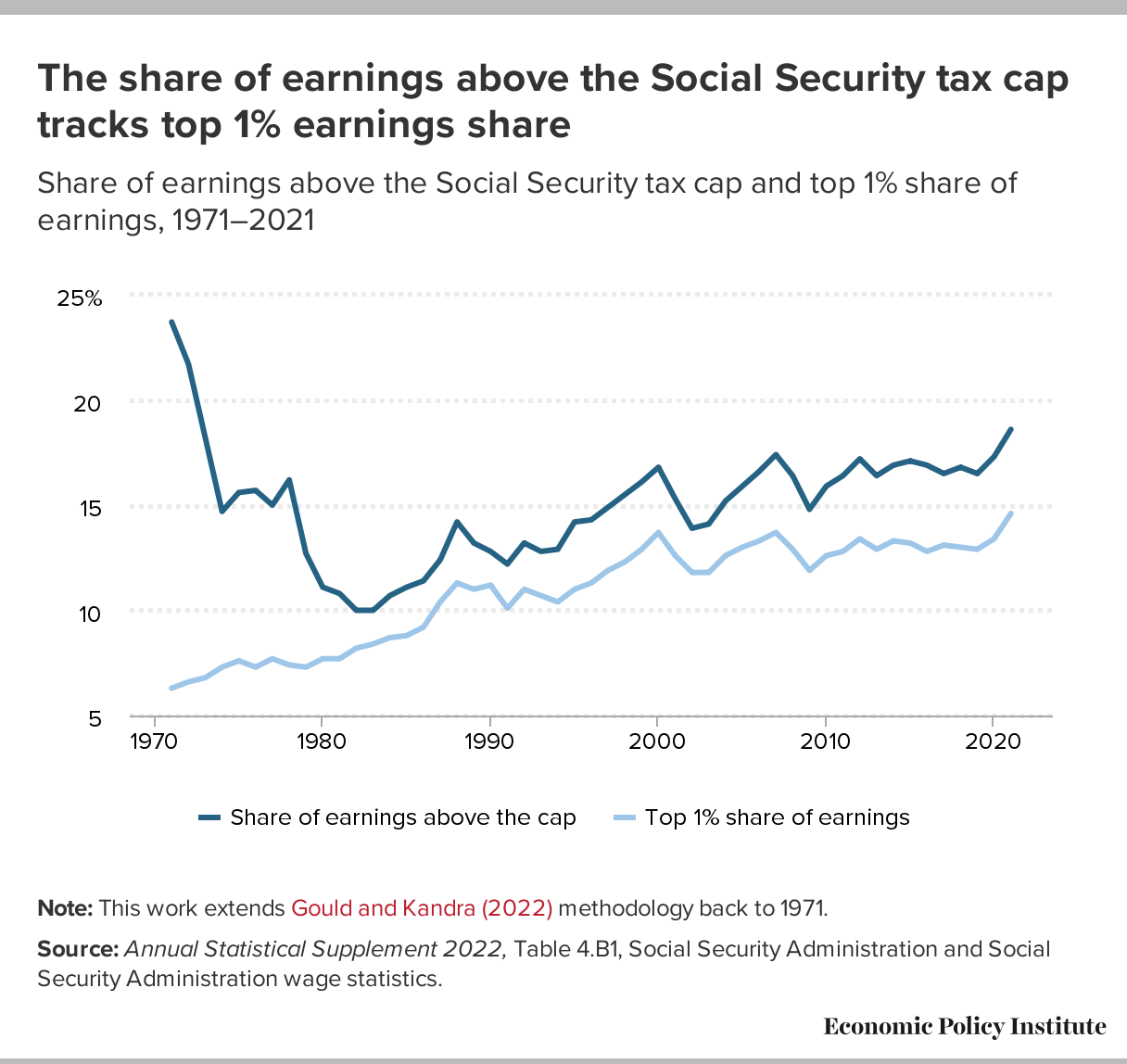

Removing the Social Security earnings cap virtually eliminates funding gap | Economic Policy Institute

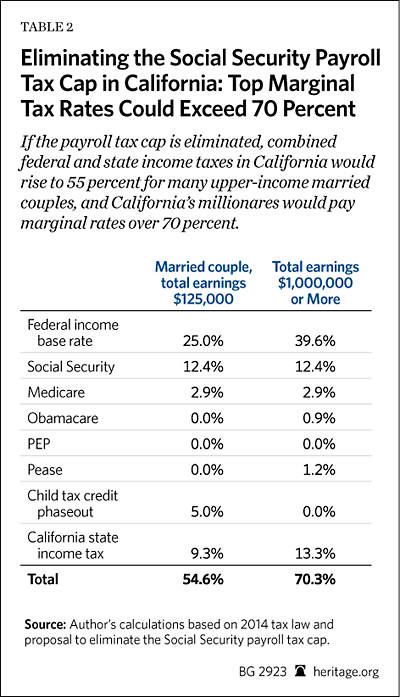

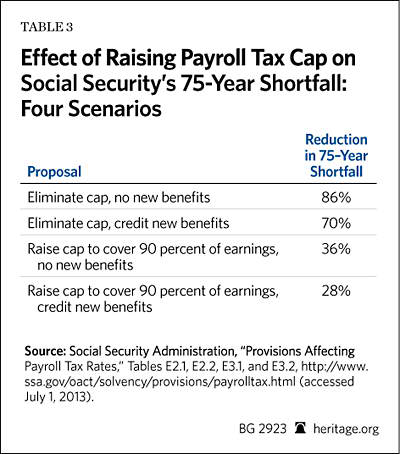

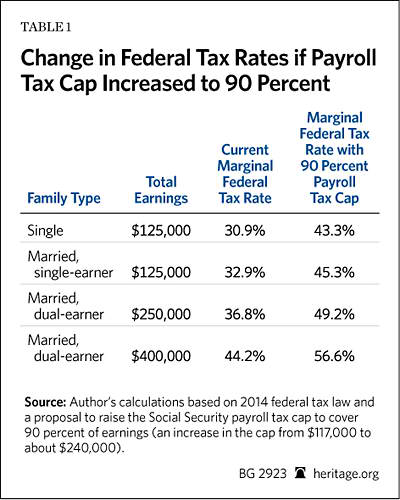

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

Raising the Social Security Payroll Tax Cap: Solving Nothing, Harming Much | The Heritage Foundation

A record share of earnings was not subject to Social Security taxes in 2021: Inequality's undermining of Social Security has accelerated | Economic Policy Institute

Richard Angwin on X: "The social security earnings cap is a subsidy for the wealthy. Ending it would close the funding gap and make social security permanently solvent. #EndTheCap https://t.co/UhINVK7yPH" / X